For 78% of Americans, homeownership is still the American dream. Homebuyers spend months searching for the perfect house and many even drain their emergency fund to come up with a downpayment. A house is still the greatest financial investment most people will make in their lifetime, so it’s important to protect your investment—and your savings—with a home warranty.

Should I Buy a Home Warranty?

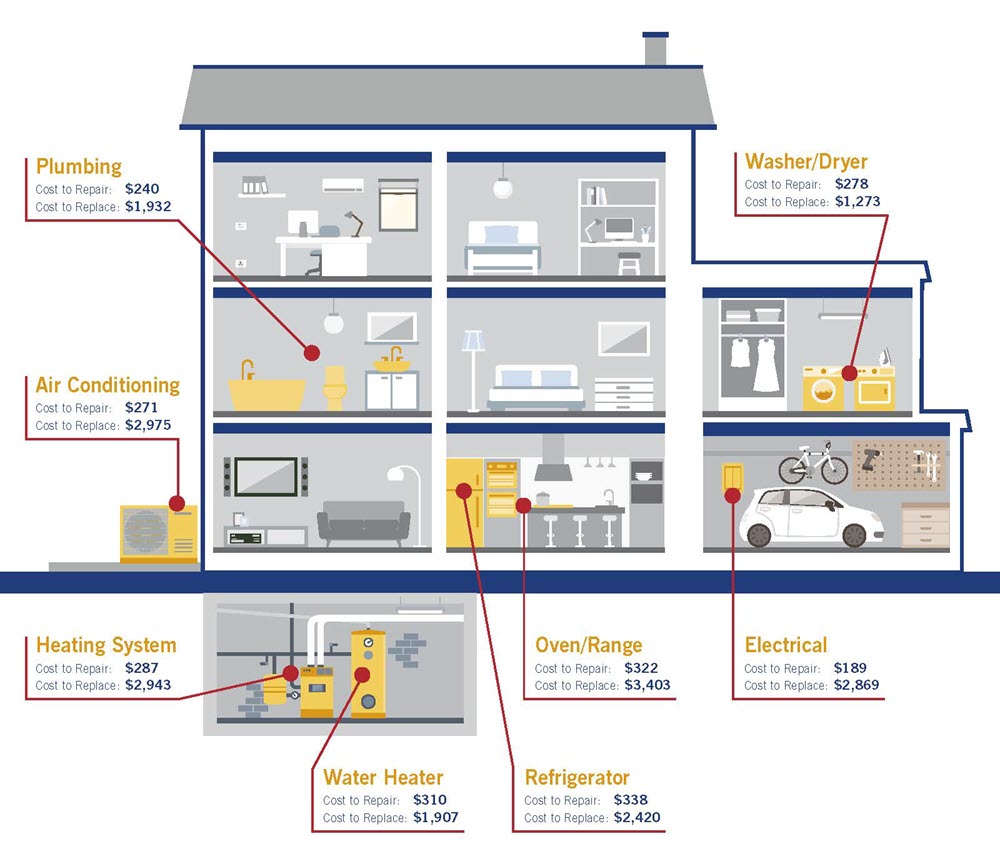

More than half of U.S. homeowners live paycheck to paycheck and the last thing they should worry about are costly repairs and replacements of their home systems and appliances. A home warranty has the potential to save you thousands of dollars when covered systems or appliances fail.

Can you comfortably afford to replace your HVAC or electrical systems? If not, then the right home warranty can provide the budget protection you need.

Can you comfortably afford to replace your HVAC or electrical systems? If not, then the right home warranty can provide the budget protection you need.

How Do Home Warranties Work?

When a covered home system or appliance breaks down due to normal wear and use, simply contact the home warranty company, pay the trade call fee (TCF), and a service provider will come to your home to diagnose and repair the problem.

Is a Home Warranty Different from Homeowners Insurance?

Homeowners insurance is an essential part of responsible homeownership. Your homeowners insurance may protect your home from catastrophes like fires, falling trees, or flooding. However, it won’t replace a worn-out water heater or repair leaky plumbing. That’s why home warranty coverage is so valuable—it offers unique protection for items not covered under typical homeowner’s insurance policies.

Homeowners Insurance Vs. Home Warranty

Would you dream of skipping homeowners insurance just to save money on your premium payments? Of course not. It’s far too risky. Skipping home warranty coverage can be just as risky!

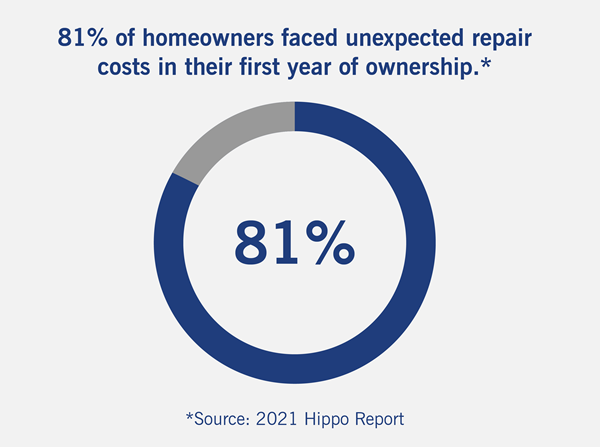

Did you know that less than 6% of homeowners file a claim against their homeowners insurance policy each year? However, 81% of homeowners face unexpected home repairs just in their first year of ownership! While homeowners insurance offers invaluable coverage against major catastrophes, home warranties provide peace of mind and budget protection for items homeowners rely on day-to-day.

What Is the Best Home Warranty Company?

When it comes to budget protection and peace of mind, it is important to choose a reliable home warranty company with a solid history of paying service requests. You’ve worked hard to achieve the dream of home ownership. Protect your savings with the right home warranty coverage.

Old Republic Home Protection (ORHP) has provided industry-leading coverage for homeowners across the country since 1974 and has maintained an A+ rating with the Better Business Bureau for over 20 consecutive years. With a hassle-free service request process and plans for every budget, ORHP prioritizes customers at every turn.

Terms and conditions apply. See your state plan for complete coverage and exclusion details.